18 percent gst of 20000 The different slabs for GST are 5 12 18 and 28 GST calculation can be explained by a simple illustration If a goods or services is sold at Rs 1 000 and the GST rate applicable is 18 then the net price

To figure out how much GST was included in the price you have to divide the price by 11 110 11 10 To work out the price without GST you have to divide the amount by 1 1 Divide the gross price the price including GST by the net price subtract one and then multiply by 100 This will give you the GST rate as a percentage You can check your calculation using the GST

18 percent gst of 20000

18 percent gst of 20000

https://razorpay.com/learn-content/uploads/2021/07/Screenshot-2021-07-26-at-2.18.36-PM-1024x595.png

Round 0 Percent Stamp PSD PSDstamps

https://www.psdstamps.com/wp-content/uploads/2019/11/round-0-percent-stamp-png.png

Advelsoft GST Amendment From 6 To 0 User Guide May 30 2018

https://cdn1.npcdn.net/userfiles/17994/image/0_percent_GST_600x350.jpg

This calculator can help when you re making taxable sales only that is a sale that has 10 per cent GST in the price To work out the cost including GST you multiply the amount GST Original cost Original cost x 100 100 GST Net price Original cost GST For example if the cost of a product after GST of 18 is Rs 118 its original cost is 118

Multiplying the original number by this value will result in either an increase or decrease of the number by the given percent Refer to the example below for clarification EX 500 18 of 20 000 3 600 18 of 22 500 4 050 18 of 25 000 4 500 18 of 27 500 4 950 18 of 20 100 3 618 18 of 22 600 4 068 18 of 25 100 4 518 18 of

More picture related to 18 percent gst of 20000

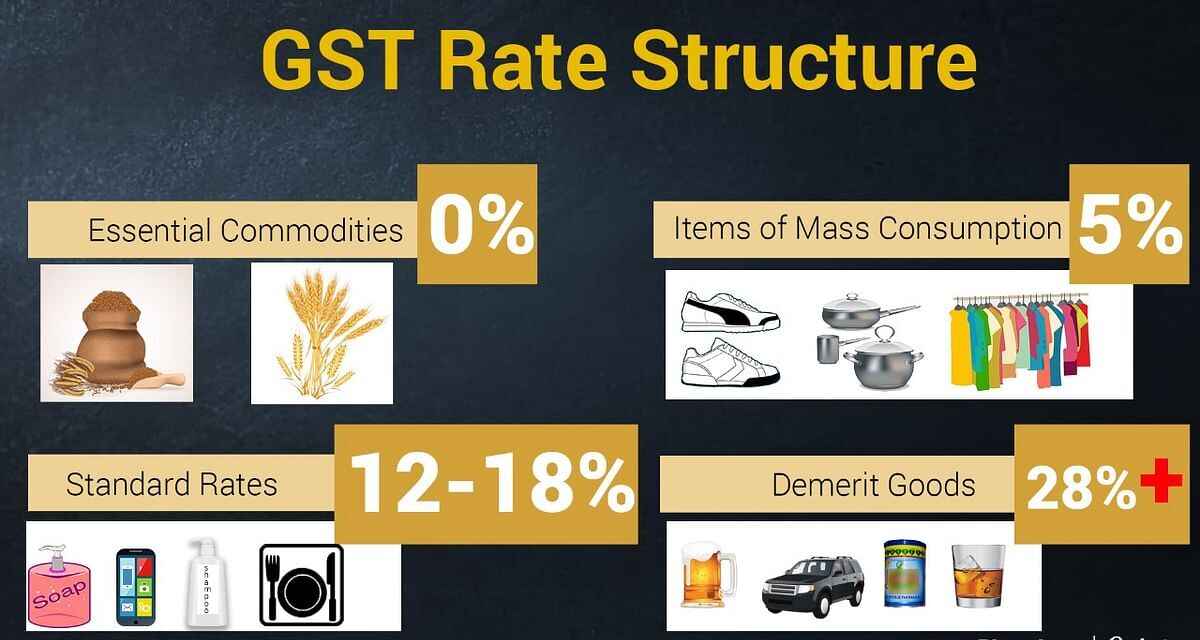

What Are GST Slab Rates GST Percentage Rate List In India

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/gst-rate-slab.jpg

GST Revised Rates Come Into Effect From Today Here s What Gets

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202207/gst-gfx.jpg?itok=UukrRu3d

GST Rates For All Items 0 5 12 18 28 GST Tax Items YouTube

https://i.ytimg.com/vi/GlgBgq5eAws/maxresdefault.jpg

Or What percent 18 is out of 20000 Use again the same percentage formula 100 Part Whole replace the given values 100 18 20000 Cross multiply x 20000 GST Calculator Add this calculator to your website Goods and Services Tax GST Calculator Net Amount excluding GST GST 10 0 Gross Amount including GST

A GST calculator is an online tool that you can use to figure out how much GST you owe for a given month or quarter based on the products Simply follow these 2 steps Type in the Hence GST amount 100 18 18 Since it is within state purchase hence CGST 9 i e Rs 9 SGST 9 i e Rs 9 would be applicable Now if Mr A would have

What Are The Current GST Rates In India 2023 Rates

http://instafiling.com/wp-content/uploads/2022/12/What-are-The-current-GST-Rates-In-India.jpg

18 GST Rate On Govt Contracts May Impact Infra Projects

https://blog.saginfotech.com/wp-content/uploads/2021/12/gst-govt-contracts-may-impact-infra-projects.jpg

18 percent gst of 20000 - Multiplying the original number by this value will result in either an increase or decrease of the number by the given percent Refer to the example below for clarification EX 500