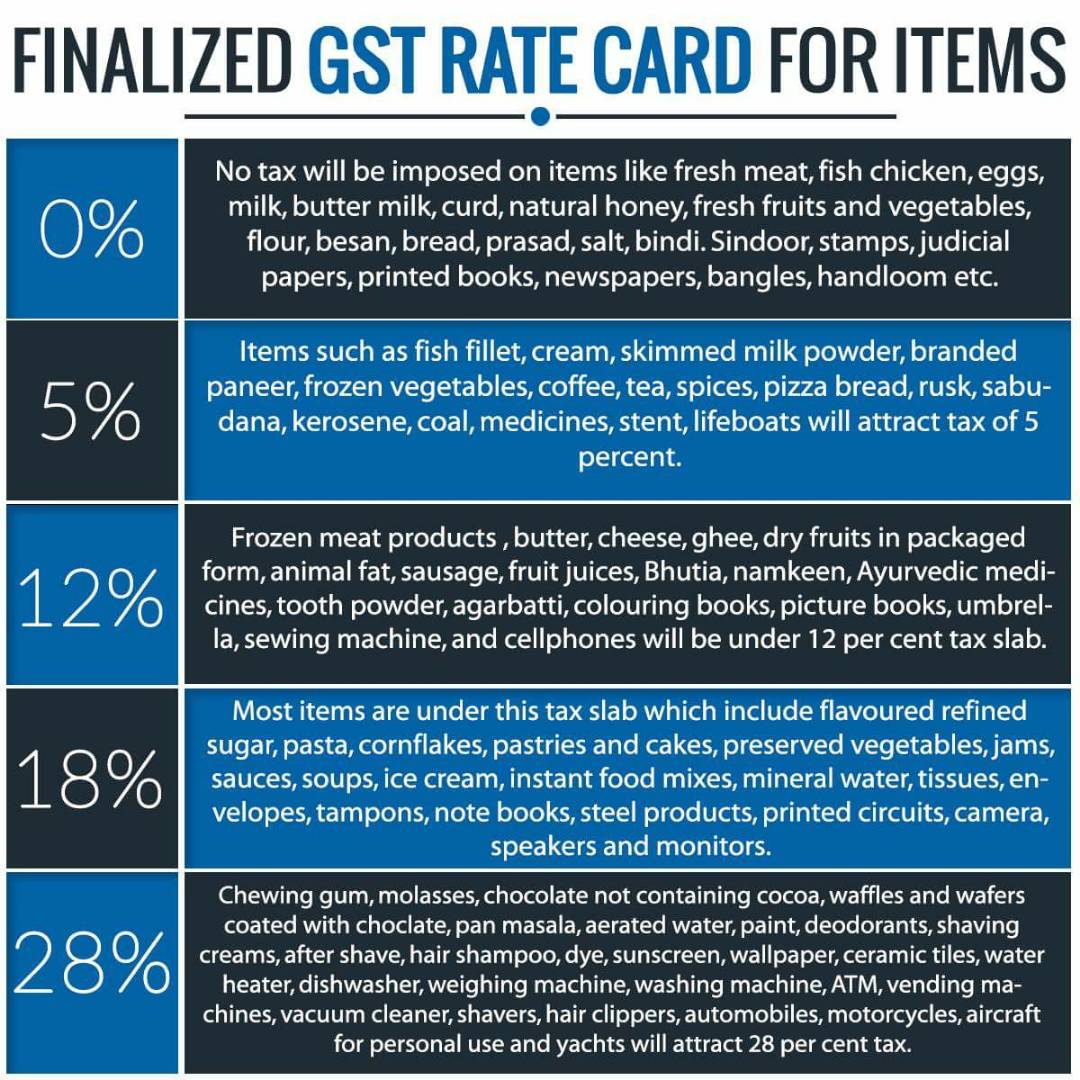

18 percent gst of 10000 The different slabs for GST are 5 12 18 and 28 GST calculation can be explained by a simple illustration If a goods or services is sold at Rs 1 000 and the GST rate applicable is 18 then

Suppose you purchased a plastic bottle from a shop for Rs 100 and it was inclusive of GST rated 18 Now if you want to calculate the amount of GST you paid on it use this GST amount Price x GST Net price Cost of the product GST amount For example if a product or service costs Rs 100 and the GST levied on that is 18 the GST

18 percent gst of 10000

18 percent gst of 10000

https://razorpay.com/learn-content/uploads/2021/07/Screenshot-2021-07-26-at-2.18.36-PM-1024x595.png

Odisha Records 13 Percent GST Growth In July The Statesman

https://www.thestatesman.com/wp-content/uploads/2020/01/iStock-691243938_ED.jpg

Advelsoft GST Amendment From 6 To 0 User Guide May 30 2018

https://cdn1.npcdn.net/userfiles/17994/image/0_percent_GST_600x350.jpg

To figure out how much GST was included in the price you have to divide the price by 11 110 11 10 To work out the price without GST you have to divide the amount by 1 1 How much is 18 of 10 000 Use this easy and mobile friendly calculator to calculate 18 percent of 10 000 or any other percentage

The simplified GST calculator helps you determine the gross or net product price on percentage based GST rates GST calculator is a handy ready to use online calculator If goods or services are sold at Rupees 10 000 with the 18 per cent GST in rupees or 18 GST in rupees then the net price NP is calculated as 10 000 10 000 18 100

More picture related to 18 percent gst of 10000

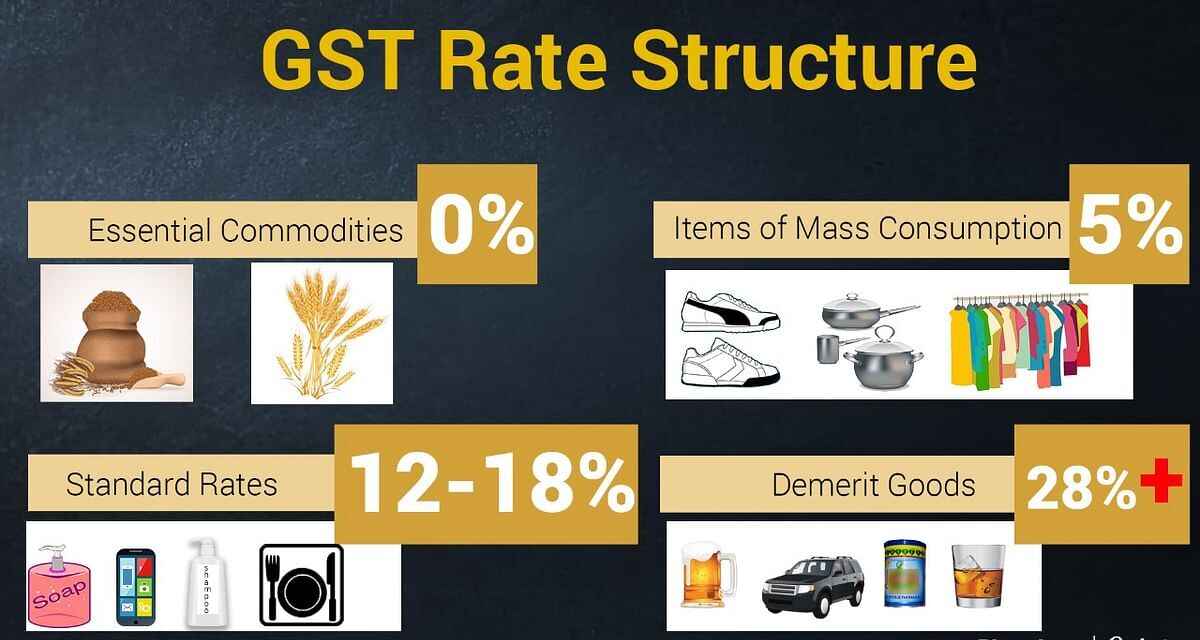

What Are GST Slab Rates GST Percentage Rate List In India

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/gst-rate-slab.jpg

Round 0 Percent Stamp PSD PSDstamps

https://www.psdstamps.com/wp-content/uploads/2019/11/round-0-percent-stamp-png.png

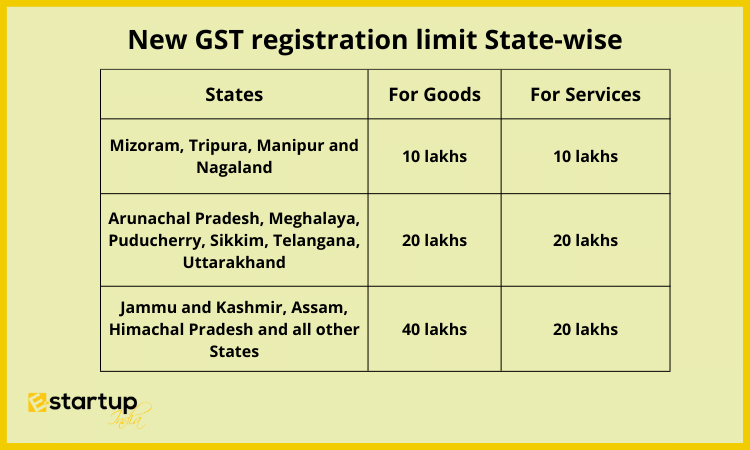

Gst Registration On Limit For Services In FY 2022 23

https://www.e-startupindia.com/learn/wp-content/uploads/2022/08/New-GST-registration-limit-State-wise.png

An online GST calculator can help you accurately calculate the amount of the tax levied on your purchase Also manual calculations can be time consuming especially when you To find out the how GST affects the price of a product or service all that one needs to do is input into the tool the original cost of the product or service and the GST rate applicable

Step 1 Open INDmoney GST calculator on your computer or smartphone Step 2 Enter the total amount price tax slab under which the product falls and select whether you are Using a simplified Goods and Service Tax Calculator online helps you figure out the gross or net price of a product depending on the amount and gives you a breakdown of the

Gst Tax Rate Chart For Fy Ay Goods And Service Hot Sex Picture

https://taxdose.b-cdn.net/wp-content/uploads/2016/09/GST-Easy-Chart.jpg

GST Rate Hikes List Of Goods And Services Which Are Expensive Now

https://akm-img-a-in.tosshub.com/indiatoday/images/bodyeditor/202207/gst-gfx-x1200.jpg?9FJEzZ96aRNPzq.f6QohSDTNh_whzjA_

18 percent gst of 10000 - After applying the values in the GST formula we conclude that 18 percent GST of 50000 in rupees is 9000 What is 18 percent GST of 10 000 GST Amount 10 000 18 100