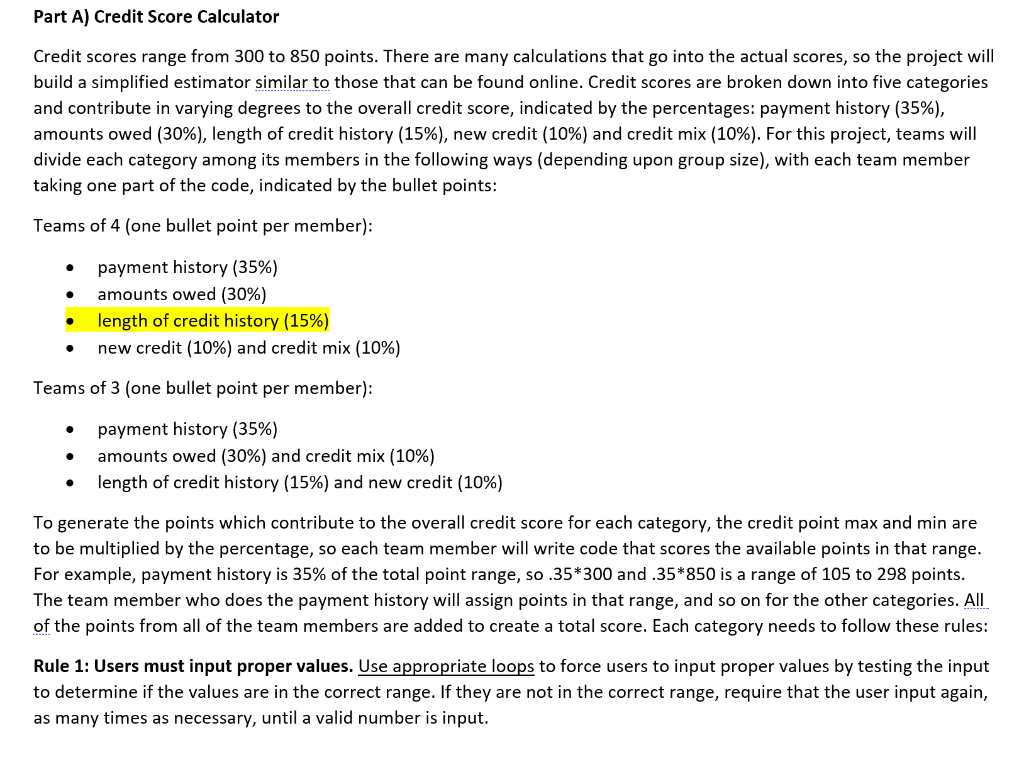

15 3 rule car loan What Is the 15 3 Rule The 15 3 hack became popular on TikTok but depending on who explains it the details of how to execute it can vary The strategy involves paying at least half of your

The 15 3 credit card payment rule is a strategy that involves making two payments each month to your credit card company You make one payment 15 days before your statement is due and another payment three days before the due date The rule is to make a 20 down payment on a four year car loan and spend no more than 10 of your monthly income on transportation expenses Because your credit score affects the size of your monthly payment you may need to buy less car if you have a lower credit score

15 3 rule car loan

15 3 rule car loan

https://www.finnable.com/wp-content/uploads/2022/01/Instant-car-loan.jpg

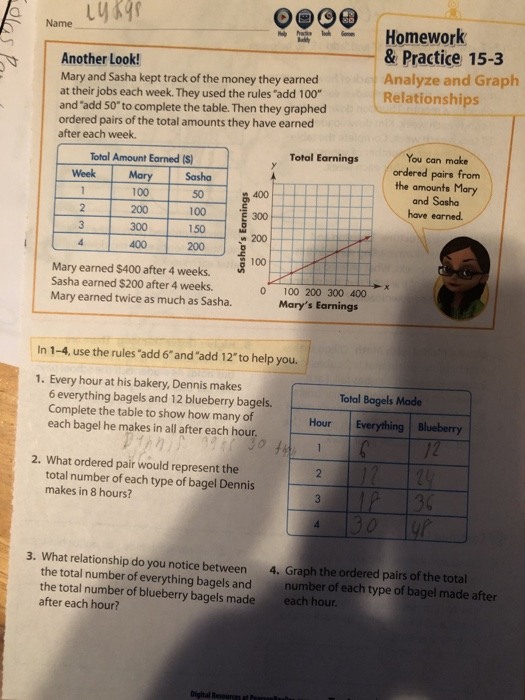

Solved Homework Practice 15 3 Analyze And Graph Chegg

https://media.cheggcdn.com/media/4cf/4cf1ee88-b591-4836-bfd9-e085bb9f7c55/image.png

15 3 Credit Card Payment What You Need To Know Lantern By SoFi

https://images.ctfassets.net/dzdmblwsahji/4n9nNCHhAjQxBBJluwnBLx/305d20f04a396783bc72e077bb40380d/online-shopping.jpg_s_1024x1024_w_is_k_20_c_ZGHeAHDNoQqUVR5i-UHhycpWjO8z6q4BEe0wXZhqJZ0___1_.jpg

Using the 15 3 hack on these cards can help you show a lower credit utilization ratio along the way Just remember that 0 APR offers don t last forever and that the high rates credit cards What is the 15 3 credit card hack The 15 3 credit hack gets its name from the practice of making your monthly payment in two installments the first half 15 days before your due date and the second half three days before your due date 1 This hack popular on various social media platforms claims to be a shortcut to good credit

Find out how the 15 3 rule for credit works in order to decide if it might be right for you What Is the 15 3 Credit Card Payment Method Most people make one payment on their credit card each month With the 15 3 credit card payment method you make two payments a month The 15 3 credit card payment hack is a method of paying down your credit card balance in a way that boosts your credit score The basic premise is that you make two monthly payments on your credit card one payment 15 days before your due date and the other three days before your due date

More picture related to 15 3 rule car loan

What Is The 15 3 Rule Riadool

https://riadool.com/wp-content/uploads/2023/07/localimages/puzzles-html-create-canvas-elem-example.jpg

What Is The 15 3 Rule For Credit Leia Aqui Does The 15 And 3 Rule

https://media.cheggcdn.com/media/a8f/a8f6c2f8-42d0-4fd6-aacc-e8dc452c80b2/phpbHMpsm

Car Loan V1 100k Example xlsx Paul Tan s Automotive News

https://paultan.org/image/2021/09/Car-loan-types-Fixed-R78-yearly-1-630x225.jpg

What Is the 15 3 Credit Card Payment Method With the 15 3 rule for credit cards instead of making one payment each month on or near the credit card payment due date you make two payments every month The 15 3 credit trick is a myth that claims you can raise your credit score faster by paying your credit card bill 15 days before the due date and again 3 days before it s due There s nothing special about either of these dates though it is a good idea to reduce your balance before your statement closing date

Here s how the 20 3 8 rule stacks up to the 20 4 10 rule Comparison Table The 20 3 8 Rule vs the 20 4 10 Rule for Car Buying According to Experian the average amount financed for a used vehicle in Q4 of 2022 was 27 768 After putting 20 down an auto loan for 3 years at 5 interest would have a monthly payment of 665 Financial experts recommend spending no more than 10 of your monthly take home pay on your car payment and no more than 15 to 20 on total car costs such as gas insurance and maintenance

3 3 3 Rule To Adopting

https://kshumane.org/images/3-3-3.png

15 3 Credit Card Payment Method What To Know SoFi

https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/SOCC0722019_780x440_mobile.jpeg

15 3 rule car loan - You can usually qualify for financial products like a mortgage or car loan but you will likely pay higher interest rates than someone with a better credit score The good credit range starts at 690