1098 e student loan interest statement The 1098 E tax form reports the amount of interest you paid on student loans in a calendar year Loan servicers send a 1098 E to anyone who pays at least 600 in student loan interest

1098 E Student Loan Interest Statement If you made federal student loan payments in 2022 you may be eligible to deduct a portion of the interest you paid on your IRS Form 1098 E is the Student Loan Interest Statement that your federal loan servicer will use to report student loan interest payments to both the Internal Revenue Service IRS and to you

1098 e student loan interest statement

1098 e student loan interest statement

http://www.phoenixphive.com/ProductImages/1098EFeda.gif

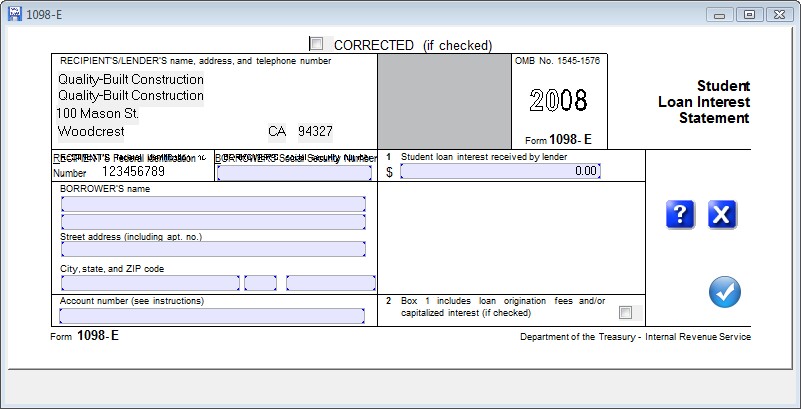

Entering Editing Data Form 1098 E

http://www.magtax.com/help/form1098e.jpg

IRS Form 1098 E Software 289 Efile 449 Outsource 1098 E Software

https://www.1099fire.com/software/strip/form_1098e_strip.png

A person including a financial institution a governmental unit and an educational institution that receives interest payments of 600 or more during the year on one or more qualified student The 1098 E form is what you receive for tax season if you paid more than 600 in student loan interest last year People receiving their 1098 E Student Loan Interest Statement can qualify to deduct student loan interest

If you pay 600 or more in interest on a qualified student loan in a year your lender or loan servicer will report the amount on the 1098 E tax form You ll need this information to calculate any student loan interest deduction Learn about Form 1098 E and student loan interest statements here What is Form 1098 E Form 1098 E is an informational form used to report student loan interest that

More picture related to 1098 e student loan interest statement

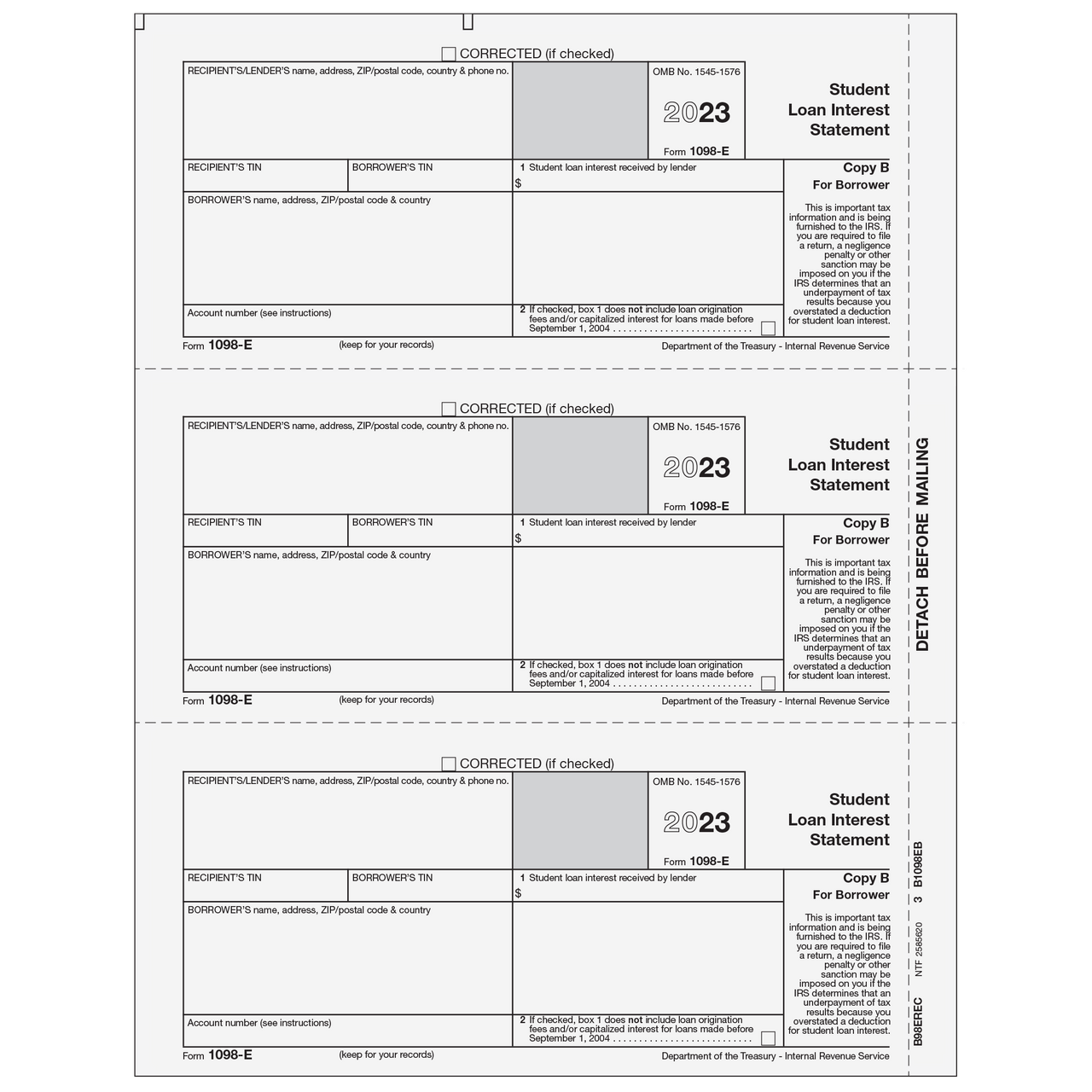

Form 1098 E Student Loan Interest Statement Recipient Copy C

http://www.phoenixphive.com/ProductImages/1098ECopyC.gif

B98EREC05 Form 1098 E Student Loan Interest Statement Borrower Copy B

https://cdn11.bigcommerce.com/s-1yt6hq6kpd/images/stencil/1280x1280/products/142/4162/b98erec05__68984.1680634954.png?c=1

Form 1098 E Student Loan Interest Statement Sign On The Page Editorial

https://thumbs.dreamstime.com/z/form-e-student-loan-interest-statement-sign-page-209661780.jpg

Any interest that you paid on qualifying student loans is generally reported to you on Form 1098 E Student Loan Interest Statement by the financial institution to which you made the To enter the amount for the interest paid From 1098 E for Form 1040 Schedule 1 line 20 Go to Screen 24 Adjustments to Income Using the Section List in the lower left

Taxpayers should expect to receive their Form 1098 E student loan interest statement from their student loan servicer or financial institution by January 31 following the Your loan servicer issues a 1098 E statement which reports the amount of loan interest paid on a student loan during the year for borrowers in repayment Some borrowers may be eligible to

What Is Form 1098 E Student Loan Interest Statement If You Paid

https://64.media.tumblr.com/aa179f272f80138857443ce8d2c0efba/tumblr_pd0zfoR74l1u1bpvro1_1280.jpg

ECSI Student Loan Tax Incentives

https://www.ecsi.net/img/1098t.gif

1098 e student loan interest statement - Learn about Form 1098 E and student loan interest statements here What is Form 1098 E Form 1098 E is an informational form used to report student loan interest that