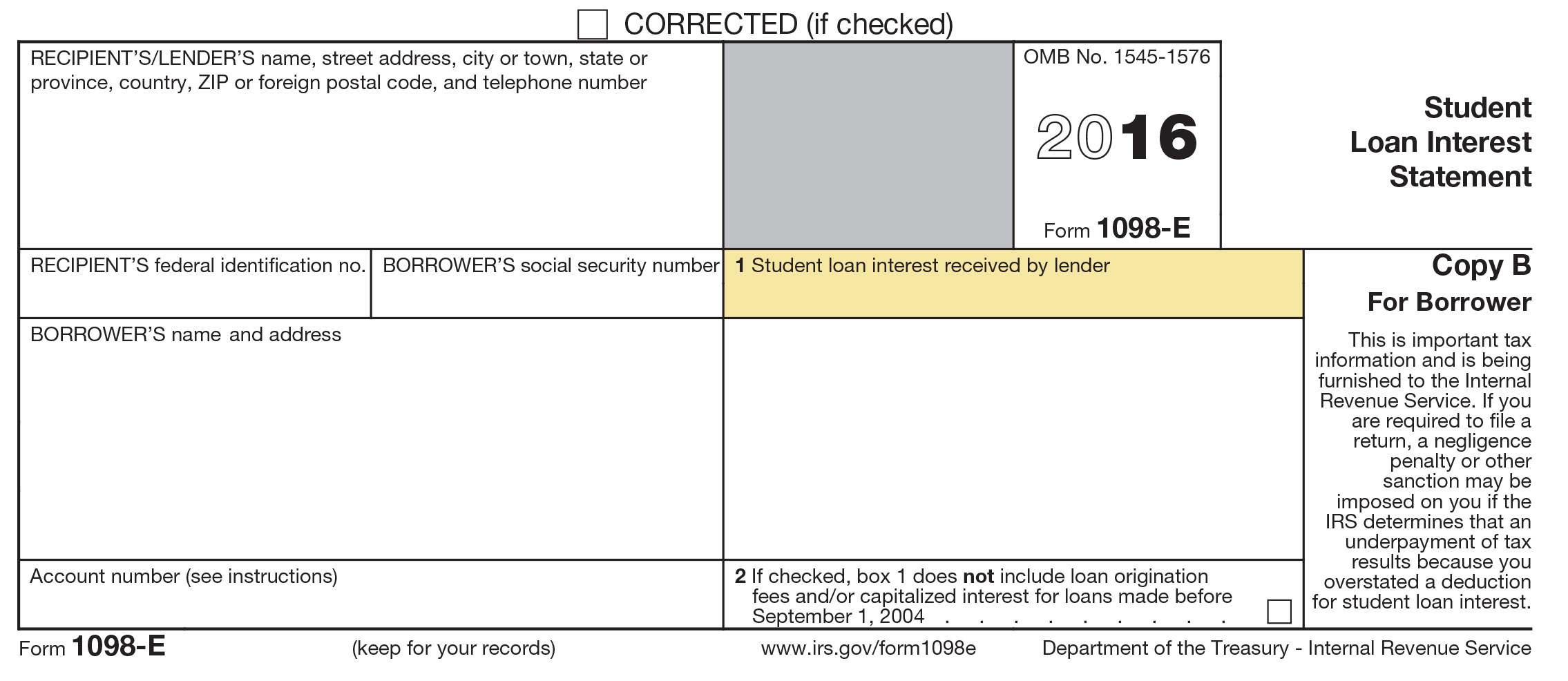

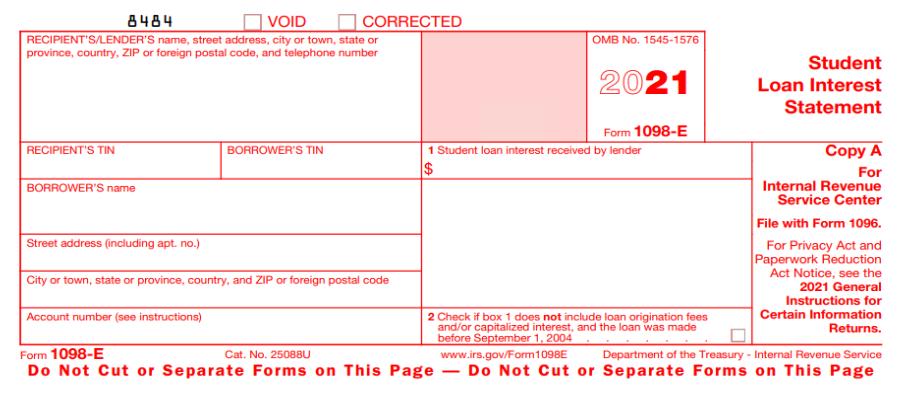

1098 e student loan interest received by lender Your student loan servicer who you make payments to will send you a copy of your 1098 E via email or postal mail if the interest you paid in 2022 met or exceeded 600

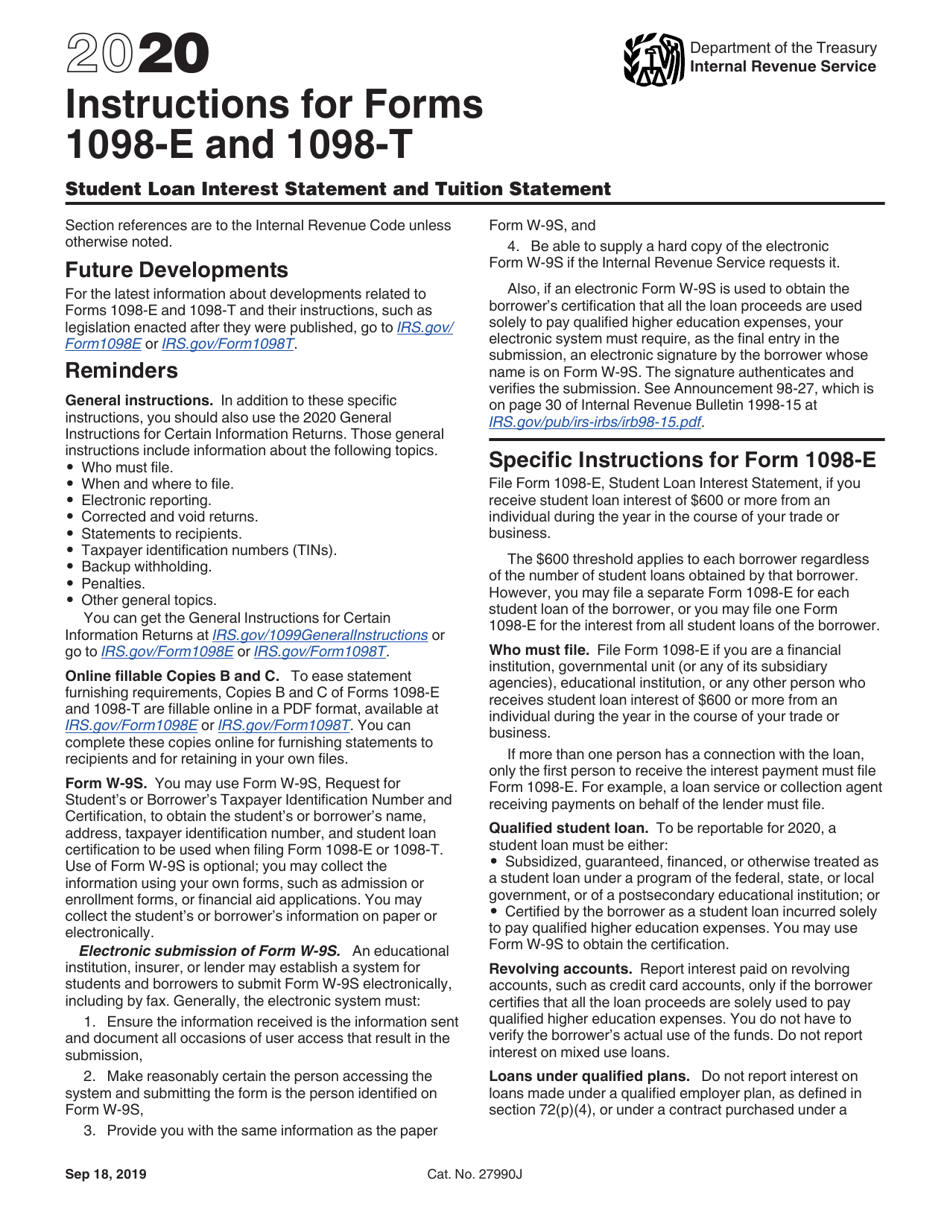

If you paid 600 or more in interest to a federal loan servicer during the tax year you ll receive at least one 1098 E The IRS only requires federal loan servicers to report payments on IRS Form 1098 E if the interest received from the File Form 1098 E Student Loan Interest Statement if you receive student loan interest of 600 or more from an individual during the year in the course of your trade or business The 600

1098 e student loan interest received by lender

1098 e student loan interest received by lender

https://americantaxtraining.com/wp-content/uploads/2022/06/form-1098-E.png

Remember To Deduct Student Loan Interest On Your Taxes IonTuition

https://s28637.pcdn.co/wp-content/uploads/2017/01/2016-1098-E.jpg

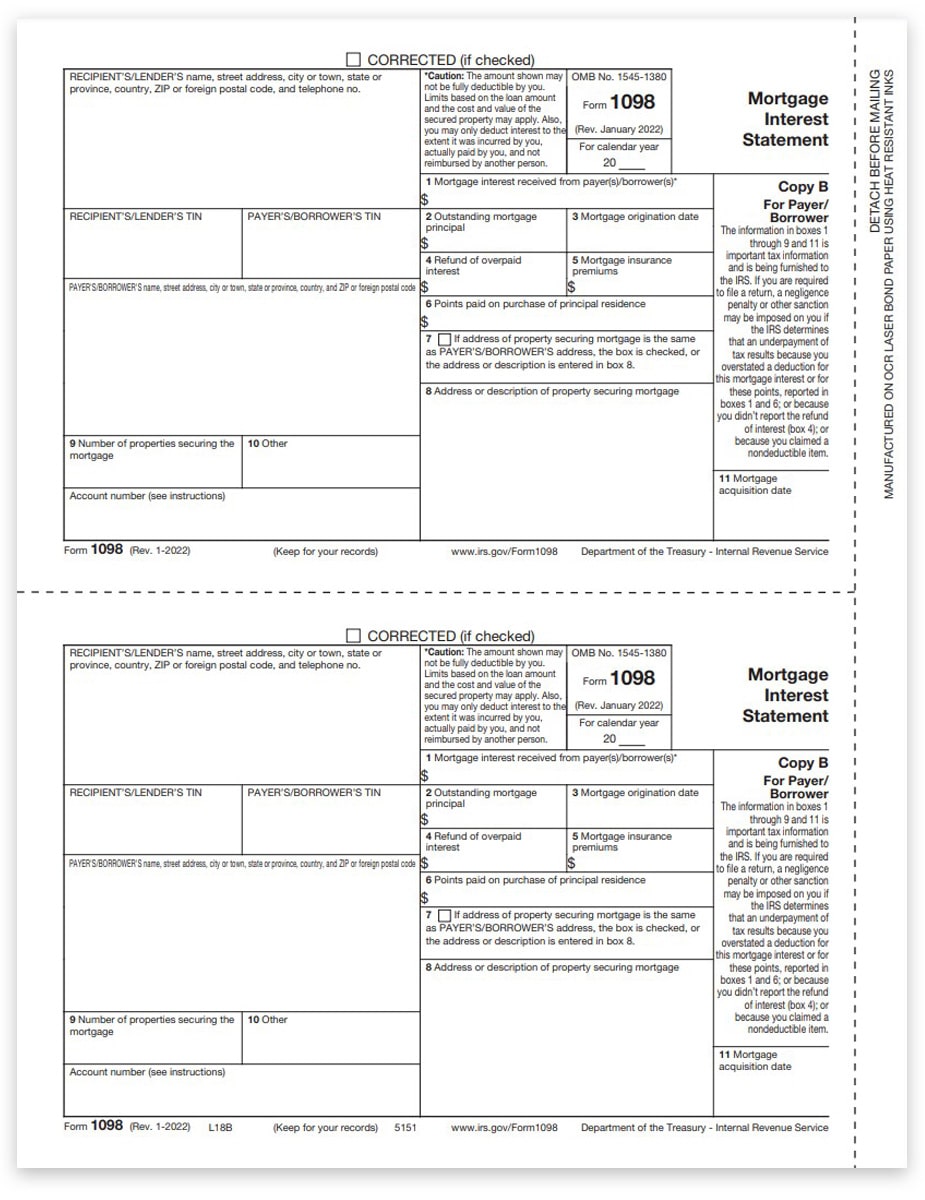

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

If you pay 600 or more in interest on a qualified student loan in a year your lender or loan servicer will report the amount on the 1098 E tax Shows the interest received by the lender during the year on one or more student loans made to you For loans made on or after September 1 2004 box 1 must include loan origination

Navient released the 1098 E form earlier today and I downloaded it in preparation for tax season In Box 1 titled Student loan interest received by lender I have an amount upwards of If you receive student loan interest of 600 or more from an individual during the year in the course of your trade or business file this form and provide a statement or

More picture related to 1098 e student loan interest received by lender

Draft 1098 E 2021 Public Documents 1099 Pro Wiki

https://wiki.1099pro.com/download/attachments/113442975/image2021-7-19_11-14-59.png?version=1&modificationDate=1626718499873&api=v2

![]()

What Is The 1098 E Student Loan Statement

https://collegeaftermath.com/wp-content/uploads/2022/07/icons8-team-FcLyt7lW5wg-unsplash-768x1152.jpg

1098 Tax Form For Mortgage Interest Payer Copy B DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

Loan servicers send a 1098 E to anyone who pays at least 600 in student loan interest If you have outstanding loans with more than one servicer you ll receive a 1098 E from each To get a 1098 E form you must have paid 600 or more in interest on your student loan debt to a lender within a calendar year but just because you ve paid less and don t receive this tax

Yes interest received by the lender is the same as interest paid It sounds like you may have a loan refinance where the capitalized interest was paid by the new loan and that is why it is a A form 1098 E Student Loan Interest Statement is used to report interest of 600 or more paid to a lender for a student loan

E file 1098 E Form For Student Loan Interest Statement

https://d2rcescxleu4fx.cloudfront.net/images/1098-E.webp

Download Instructions For IRS Form 1098 E 1098 T Student Loan Interest

https://data.templateroller.com/pdf_docs_html/2017/20172/2017239/instructions-for-irs-form-1098-e-1098-t-student-loan-interest-statement-and-tuition-statement_print_big.png

1098 e student loan interest received by lender - If you pay 600 or more in interest on a qualified student loan in a year your lender or loan servicer will report the amount on the 1098 E tax