1098 e student loan interest lacerte Entering qualified student loan interest In ProConnect Tax go to the Input Return tab On the left side navigation menu select Deductions and select Adjustments to Income Along the top

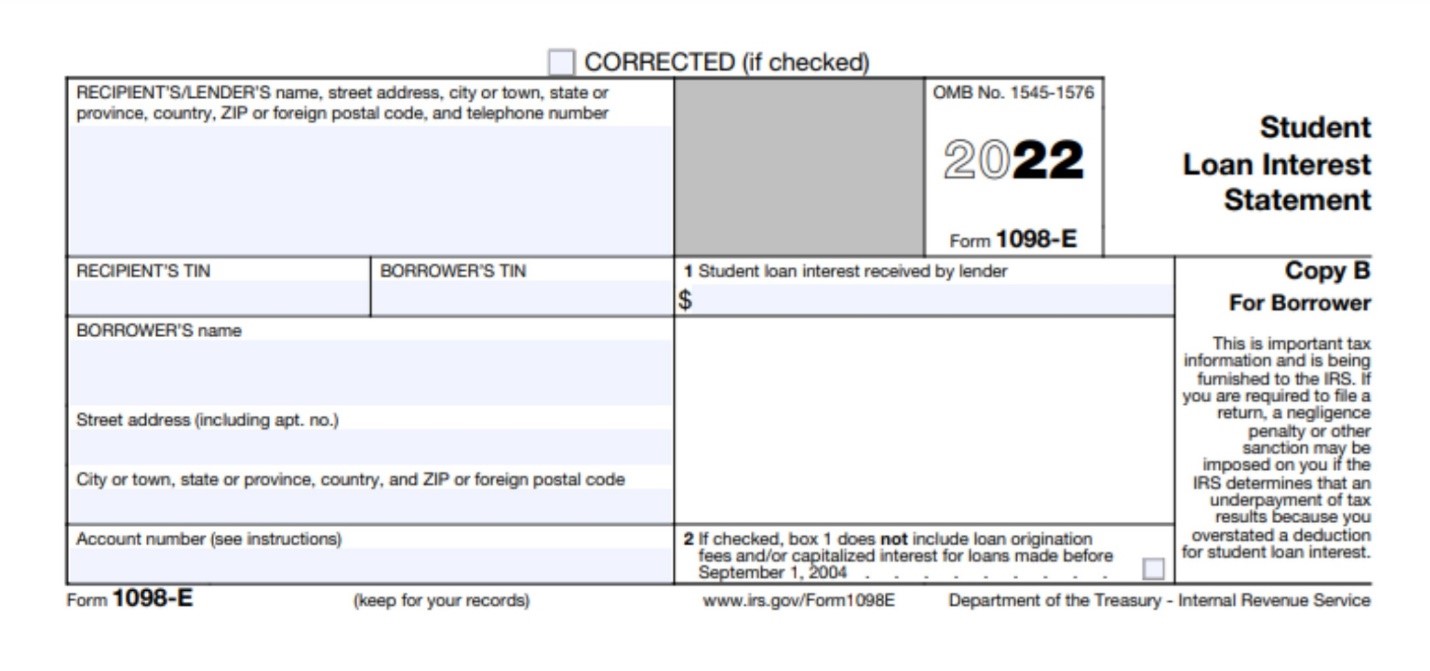

Screen 25 Itemized Deductions Home mortgage interest points on Form 1098 A Refer to Entering home mortgage interest and other information from Form 1098 in The IRS only requires federal loan servicers to report payments on IRS Form 1098 E if the interest received from the borrower in the tax year was 600 or more although some federal

1098 e student loan interest lacerte

1098 e student loan interest lacerte

https://i.ytimg.com/vi/QJNY02cZlCs/maxresdefault.jpg

Form 1098 E American Tax Training

https://americantaxtraining.com/wp-content/uploads/2022/06/form-1098-E.png

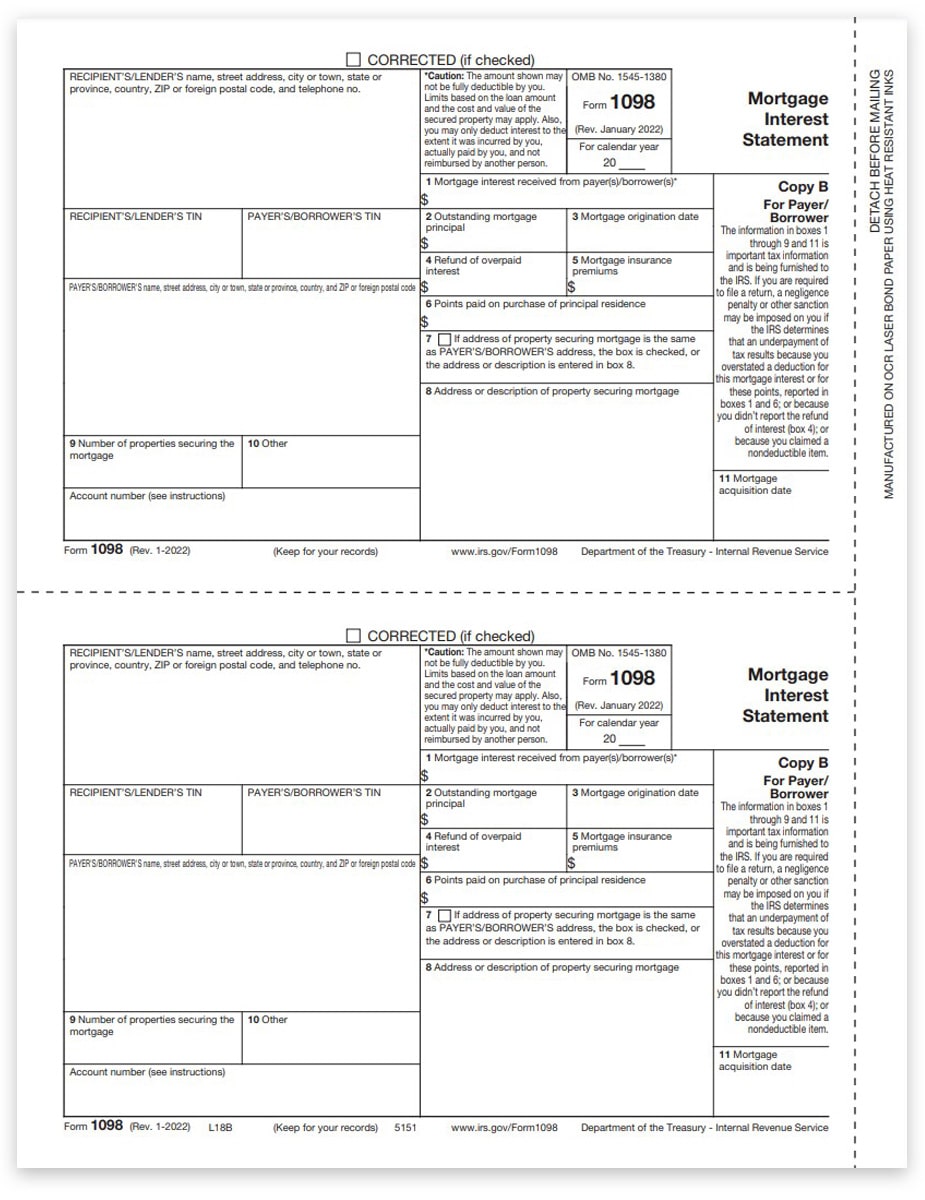

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

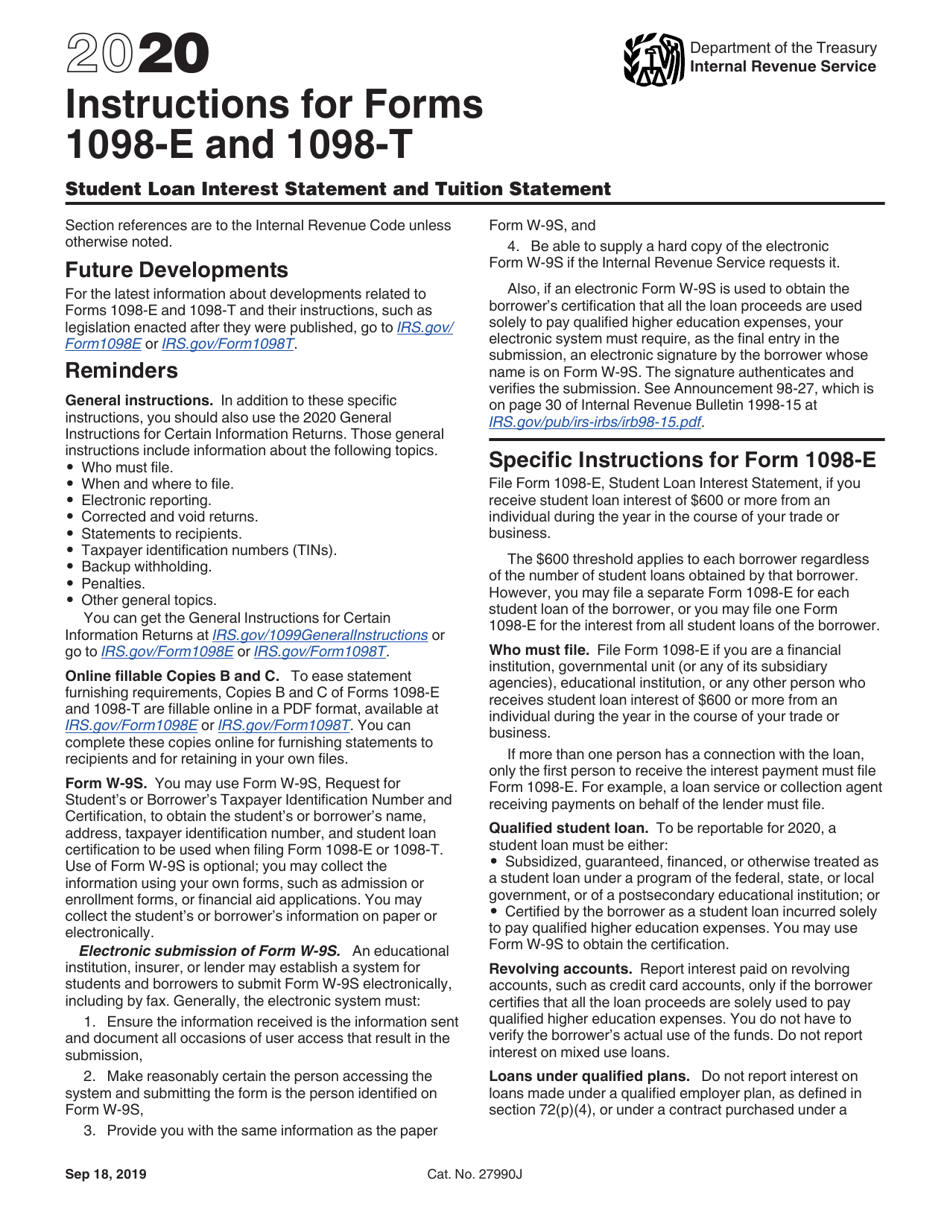

Information about Form 1098 E Student Loan Interest Statement Info Copy Only including recent updates related forms and instructions on how to file File this form if File Form 1098 E if you are a financial institution governmental unit or any of its subsidiary agencies educational institution or any other person who receives student loan interest of

1098 E Student Loan Interest Statement If you made federal student loan payments in 2022 you may be eligible to deduct a portion of the interest you paid on your If you received a 1098 E for interest that you paid on qualifying student loans during the tax year to enter go to Federal Section Select My Forms Deductions Adjustments to Income

More picture related to 1098 e student loan interest lacerte

1098 Tax Form For Mortgage Interest Payer Copy B DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

Download Instructions For IRS Form 1098 E 1098 T Student Loan Interest

https://data.templateroller.com/pdf_docs_html/2017/20172/2017239/instructions-for-irs-form-1098-e-1098-t-student-loan-interest-statement-and-tuition-statement_print_big.png

![]()

What Is The 1098 E Student Loan Statement

https://collegeaftermath.com/wp-content/uploads/2022/07/icons8-team-FcLyt7lW5wg-unsplash-768x1152.jpg

You can use Form 1098 E to find out how much student loan interest you paid during the tax year You can deduct up to 2 500 of student loan interest from your taxable income if you meet certain conditions Enter the information from Form 1098 E on the Student Loan Interest Deduction Worksheet in ProSeries Press F6 to bring up Open Forms Type STU and press Enter Enter

Lacerte Tax Software 2018 Student Loan Interestaccountinginstruction By TurboTax 836 Updated 2 weeks ago Here s how to enter your student loan interest Follow these instructions whether or not you received a 1098 E from your lender

E file 1098 E Form For Student Loan Interest Statement

https://d2rcescxleu4fx.cloudfront.net/images/1098-E.webp

How To Get A Copy Of IRS Form 1098 E

https://www.taxdefensenetwork.com/wp-content/uploads/2022/02/form-1098-e-instructions.jpg

1098 e student loan interest lacerte - Receive student loan interest of 600 or more from an individual during the year in the course of your trade or business The 600 threshold applies to each borrower regardless of the number