1031 Tax Free Exchange Worksheet WorkSheet 1 Calculation of Basis WorkSheets 2 3 Calculation of Exchange Expenses Information About Your Old Property WorkSheets 4 5 6 Information About Your New Property Debt Associated with Your Old and New Property Calculation of Net Cash Received or Paid WorkSheets 7 8 Calculation of Form 8824 Line 15

The year of the exchange stop here If either line 9 or line 10 is Yes complete Part III and report on this year s tax return the deferred gain or loss from line 24 unless one of the exceptions on line 11 applies 11 If one of the exceptions below applies to the disposition check the applicable box Under the Tax Cuts and Jobs Act Section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property An exchange of real property held primarily for sale still does not qualify as a like kind exchange

1031 Tax Free Exchange Worksheet

1031 Tax Free Exchange Worksheet

https://www.adventuresincre.com/wp-content/uploads/2018/01/1031.jpg

1031 Worksheets

https://www.viralcovert.com/wp-content/uploads/2018/11/1031-exchange-forms.jpg

1031 Exchange Worksheet Excel Free Download Goodimg co

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/reverse-1031-exchange-forms.jpg

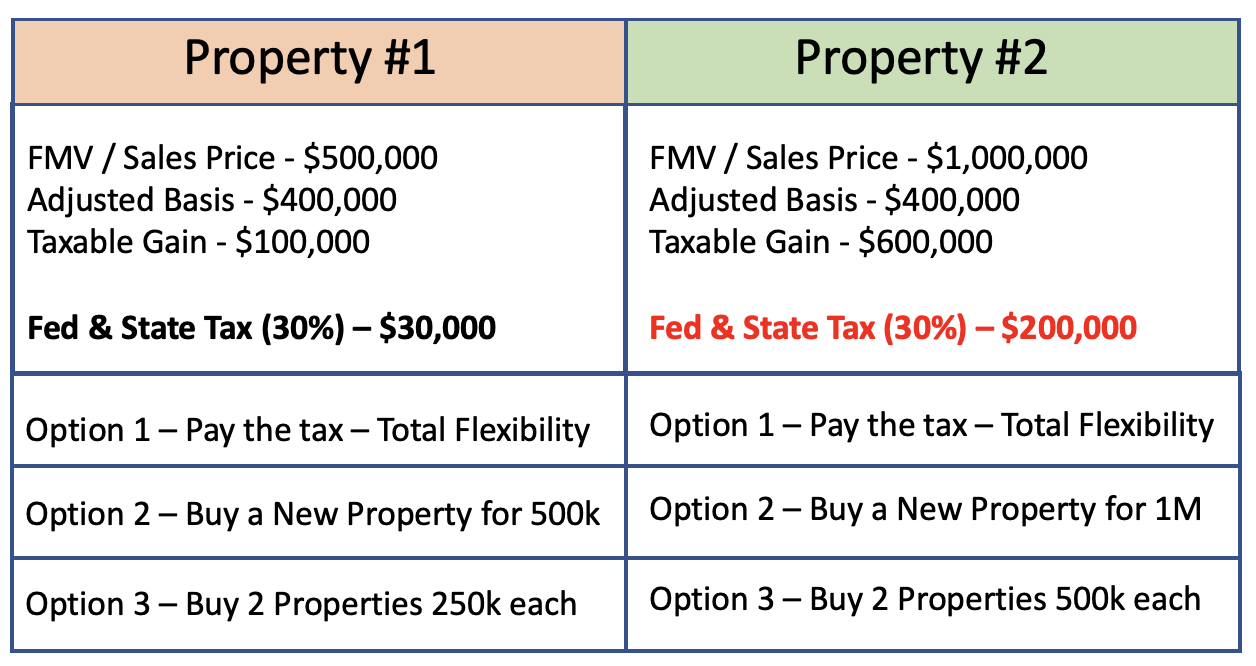

This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase To pay no tax when executing a 1031 Exchange you must purchase at least as much as you sell Net Sale AND you must use all of the cash received Net Cash Received A 1031 exchange named after section 1031 of the U S Internal Revenue Code is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to

Download The Free 1031 Exchange Calculator Are you looking for passive real estate investments First Name Last Name Email Phone Number Zip Code Your role in 1031 Exchange By providing your email and phone number you are opting to receive communications from Realized A 1031 Exchange or Like kind Exchange is a strategy in which a real estate investor can defer both capital gains tax and depreciation recapture tax upon the sale of a property and use that money which has not been taxed to purchase a like kind property Important Note This material has been prepared for informational purposes only and is

More picture related to 1031 Tax Free Exchange Worksheet

The Power Of The Section 1031 Tax Deferred Exchange Free Spreadsheet

https://activerain.com/image_store/uploads/4/7/1/2/3/ar123309083532174.png

1031 Exchange Worksheet 2022 Printable Word Searches

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/09/1031-exchange-worksheet-report-s-like-kind-example.jpg

1031 Exchange Worksheet Excel TUTORE ORG Master Of Documents

https://www.journalofaccountancy.com/content/dam/jofa/archive/issues/2002/06/witmer-ex2.jpg

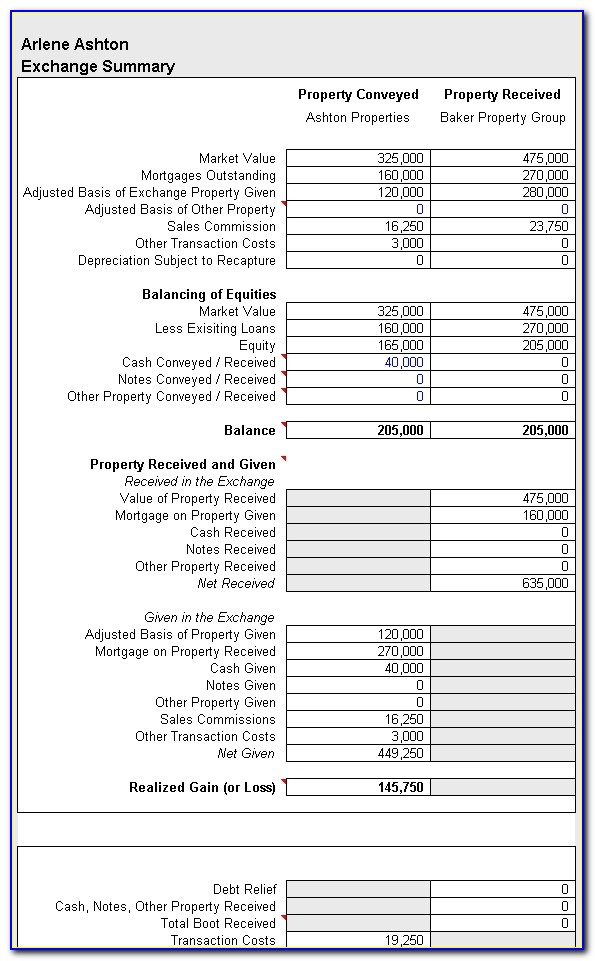

Form 8824 Worksheet is a useful tool for preparing the tax return of a 1031 exchange a transaction that allows you to defer capital gains taxes on the sale of an investment property Download the Excel file and follow the instructions to calculate the adjusted basis realized gain recognized gain and deferred gain of your exchange Tax Deferred Exchanges Under IRC 1031 Worksheet 1 Taxpayer Exchange Property Replacement Property Date Closed Before preparing Worksheet 1 read the attached Instructions for Preparation Of Form 8824 Worksheets Then prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3

A 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred The term which gets its name from Section 1031 of the Internal This tax worksheet examines the disposal of an asset and the acquisition of a replacement like kind asset while postponing or deferring the gain from the sale if proceeds are re invested in the replacement asset click the Tax Flowcharts item group button and view the Like Kind Exchange tax flowchart Was this article helpful Yes No

1031 And 1033 EXERCISE In The Following 1031 Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/fd3/fd3877af-1981-43ab-b7f2-b9aa2d7216ff/php93FFm3.png

When And How To Use The 1031 Exchange Mark J Kohler

https://markjkohler.com/wp-content/uploads/2022/08/1031-Examples.png

1031 Tax Free Exchange Worksheet - A 1031 Exchange or Like kind Exchange is a strategy in which a real estate investor can defer both capital gains tax and depreciation recapture tax upon the sale of a property and use that money which has not been taxed to purchase a like kind property Important Note This material has been prepared for informational purposes only and is